Subscription & Membership Models Are Lucrative, Recurring Revenue, Money-Makers. Do You Have One? Fully Optimized & Maximized?

- Dec 05, 2024

- The Big Innovations Team

- Silicon Valley, California

Subscription and membership models can be the ultimate profit-generating solution for companies that manage or produce almost ANY kind of digital or physical deliverable naturally consumed over time. ANY concepts, content, media, services, etc. best conveyed over a span of time via print or digital publishing, audio, video, webcast, etc, are excellent kernels to grow into a new revenue stream. While a list of possibilities could be nearly endless, here's just a few to illustrate range... and maybe ignite your imagination:

- Education,

- Investment advice,

- Newsletters,

- Razors,

- Podcasts/Vodcasts,

- Services,

- How-to guides,

- Medical, Health & Exercise,

- SAAS,

- Customer support,

- Beauty,

- Recipes,

- People care,

- Artisan coffee blends,

- Coaching & Consulting,

- Delivery/transport,

- Specialized blog,

- Comic books,

- Jewelry & Watches,

- Software Apps,

- Security,

- Tools & Equipment,

- Magazines,

- Cars & Boats,

- Technical niches,

- ________-of-the-month club,

- Stock, futures, options, mutual funds, commodity, etc, trading recommendations,

Etc. There are so many more! Think of anything for which you regularly pay. 'Regularly' is the key word. Any such item or service could very likely be packaged as a subscription or membership offering. If in doubt about your idea, ask us.

ANYTHING a bit hard to get, exclusive or uniquely your own creation... that makes subscribers feel special or getting in on something uncommon, a cut above, different... virtually anything that people might pay to read, hear, watch, learn, use, etc. over time (not all at one time) can be ideally packaged & sold for an almost unlimited stream of RECURRING revenue.

The big benefit is the obvious one. If you currently have a revenue model that resets to zero (sales) at the start of each year, you face the daunting task of replacing last year's numbers with this year's PLUS growth... starting from scratch. You have to find all those new customers to buy at least as much as the new customers you found last year. And sales targets are always set higher, though selling resources tend to remain about the same. This simply BEGS for a better way...

The big benefit is the obvious one. If you currently have a revenue model that resets to zero (sales) at the start of each year, you face the daunting task of replacing last year's numbers with this year's PLUS growth... starting from scratch. You have to find all those new customers to buy at least as much as the new customers you found last year. And sales targets are always set higher, though selling resources tend to remain about the same. This simply BEGS for a better way...

A subscription model sells existing customers again and again. The seller must jump through similar hoops to win the very first sale, but sale number 2+ (the renewals) are often much simpler, yet at least as lucrative... and usually much more so. Consider this in 2 examples:

- Think about a landlord:renter relationship as an illustrative proxy of a subscription relationship. The landlord may have to spend money on ads to attract a new renter, then put some labor into showing the home up front (not so different than the kinds of marketing & selling tasks conducted in a non-subscription business model to sell a brand new customer). However, once that renter "subscribes," the landlord will have to do next-to-nothing to get paid just as much in month 2, month 3, month 4 and so on. Cost of "renewals" are generally far below cost of acquisition (COA), making follow-up subscriber transactions tremendously lucrative compared to having to replace each customer transaction (tenant) with a completely new customer transaction (a new tenant) from scratch.

- In annual timetables it's even more exciting. Your auto insurance can be another familiar & illustrative proxy of a subscription relationship. Once every 6-12 months, all they have to do is send/email you a bill and you probably pay it time after time- perhaps for MANY years until you decide to shop anew for auto insurance. You were some marketing & selling cost to them when they first acquired you as a customer (some portion of their advertising, some costs of setting up a new account in their system, some processing to produce your policy, etc.). However, on policy renewals, you likely pay MORE each year and all they have to do is send a renewal notice. Subsequent transactions have less cost (they don't have to acquire you as a brand new customer again) yet yield a BIGGER, probably-more-profitable sale. This can repeat for several years, growing revenue-per-subscriber without having to actually absorb COA into any transaction after the first one.

ESTIMATING YOUR RECURRING REVENUE POTENTIAL

We created a simple calculator so you can do some quick, "what-if" math. Change either or both to ANY numbers to better fit whatever you are considering in your own model. For starters, it shows:

- $300 for annual revenue per subscriber, which is only $25 per month, and

- 50,000 subscribers.

$300 from 50,000 subscribers is 15 MILLION DOLLARS. That's RECURRING revenue, not a one-time transaction tally. Deliver something they like and odds are high that most of those subscribers will renew again & again & again. That's $15M revenue again & again & again. Keep them for- say- 5 years and that's $75M. Keep them for 10 and that's $150M.

If you do not yet have a subscription model, one VERY CONSISTENT assumption made is UNDERESTIMATING subscriber quantity potential: the aspiring subscription model entrepreneur almost always assumes much fewer subscribers than they can actually get... not because they are being conservative, but by simply guessing wrong.

Fire up your imagination! Must your concept be limited to the same general space as your traditional market? Must it be limited by geography? Is there a GLOBAL reach opportunity here? If whatever you want to deliver could be fulfilled at almost ANY scale, don't be too quick to think so small.

don't be too quick to think so small.

There's a whole world of potential subscribers out there... about 8 BILLION people. If you happen to have a concept that could deliver through the Internet, almost ALL of them are market potential. Carve out a slice of 8 Billion and almost any number offers an amazing revenue yield. For example, what is only 2% of 8 Billion? How about 1%? One-half of 1%? One tenth?

Can what you want to sell be fulfilled in a mobile app? That market is above 2 BILLION. Again, carve out only a fraction of 1% from 2 billion and the subscriber count number is probably higher than you last guessed in the calculator. What is one-half of 1% of 2 billion smart device users? 10 MILLION SUBSCRIBERS. What is one-tenth of 1%? 2 MILLION subscribers. You have to REALLY think pessimistically to get down to under 10,000 subscribers: less than 0.0005% of THAT gigantic market.

If you punched tiny numbers into Quantity of Subscribers, we hope this moves you to re-think upside: the market is PROBABLY MUCH BIGGER than your current guess.

DEVELOPING OR ENHANCING A SUBSCRIPTION BUSINESS MODEL

Our team has DECADES of experience working in some of the most lucrative subscription models on earth. We've battled fierce competition while mastering nitty-gritty nuances of what works & what doesn't. We've pioneered breakthroughs to rapidly grow membership and subscriber models while dazzling customers & forging long-term loyalty. Our latest "from scratch" subscription model installation has already become the most profitable division of our client's company (they didn't even have a subscription model before this one). We are masters at helping companies turn ideas into very profitable subscription businesses.

There are three great topics available below. For those relevant- or just interesting- to your situation, click the question to see detailed answers...

We can make it stronger. Let us take an expert look and show you ways to enhance your model. Our quick diagnostic processes can reveal opportunities for improvement. Competitor (and non-competitor) breakthrough innovations will very likely apply. Outsider eyes exposed to a wide variety of models can recognize such fits... including how innovations not already in play at your direct competitors can give you first advantage in your space. Try us. We will find something Grrrrrrrreat!

We can make it stronger. Let us take an expert look and show you ways to enhance your model. Our quick diagnostic processes can reveal opportunities for improvement. Competitor (and non-competitor) breakthrough innovations will very likely apply. Outsider eyes exposed to a wide variety of models can recognize such fits... including how innovations not already in play at your direct competitors can give you first advantage in your space. Try us. We will find something Grrrrrrrreat!

Assuming we DO see some great opportunities for your business- and WE ALWAYS DO- we're also ready to roll up our own sleeves and turn our recommendations into reality.

As part of what we'll suggest for your business, we also identify a simple test(s) to objectively weigh impact BEFORE there is full commitment. Innovations or fixes that are obvious to you can simply be put in play. Those that may seem less obvious can be tested. Test results are the ultimate guide to incremental improvements with minimal risk. Test, let it prove itself to you firsthand, and then fully implement with great confidence of KNOWING it yields better.

One great bonus of running a subscription model is the easy ability to test new ideas... to PROVE an enhancement recommendation yields better than the status quo.

Any successes are likely to yield more for you for up to forever. What would even ONE improvement mean to your business this year? And in the next few years? And beyond as it keeps right on yielding that extra?

Again, EVERY model we've ever examined has always had ample room for tangible gains. Our caliber of actionable recommendations can significantly add to your bottom line. We would love to show you that money!

We can design a thoroughly-optimized model from scratch, catering to the unique needs of your business. This can be a turnkey service and/or we can teach your own resources how to do it all right. Want fastest-possible results? We could help you source a relevant ACQUISITION candidate with an established subscription model on which you could build. Buying a subscription model can be a faster path to subscription revenue than building one from scratch... and comes with the bonus of an established base already accustomed to paying the subscription fee.

If you are not in that much of a hurry, building one from scratch means getting to cater it to every insider want- exactly as you want it- and going to market with a clean (reputation) slate. Bring us the basic seed for such a business- often only an idea for a subscription model- and we'll help you gauge its suitability & validity.

If it looks favorable to work well for you, we can help you with BOTH key phases of development... what we call "get ready" (to go to market) and then "go." The former is where we build out very impressive foundational assets that you can use for upwards of many years. The latter is smart launch marketing & creative to monetize those assets. BOTH must be done well to be at least toe-to-toe with established competition and motivate the market to take you seriously.

GETTING READY TO GO TO MARKET

- write the sharpest business plan to maximize the agility, understanding, communications and execution of your team, so that everything gets done best-in-class, on time & on budget. If you are wanting to attract investors for startup capital, a great business plan is an absolute must.

- manage all new product development or repackage existing materials you produce into a highly desirable product and brand.

- create all of the related web pages (or a complete website) to help lure in prospects wanting to subscribe and move more existing members to stay and renew.

- help you take advantage of the massive & rapidly growing mobile app market (over 2 BILLION strong) so you can sell & deliver subscriptions to your product or service via Apple iPhones, iPads, iPods, Google Android devices, Roku and others. We offer up to turnkey services: 1) fleshing out your app concept, 2) recommending & managing the programmers and 3) doing all of the pre-launch, launch and post-launch marketing to fuel success.

- source the various technologies- many off the shelf- to make it as easy as possible to manage your subscriber database and capitalize on many ancillary benefits therein.

- related or specific-to-your-business development & tasks. For example, if your business is personality driven, we can develop the personality story, image, etc. If you need fulfillment solutions, we can help you figure out the best options. If the idea involves a tiered offering, we'll contribute to optimizing and differentiating the tiers. If you need the confidence boosts of some quality prospective buyer research and competitive analysis, we can do those for you with fully objective lenses. And so on. In general, think ONE-STOP-SHOP for WHATEVER you may want or need to do this right.

GO TO MARKET WITH AN "ON TARGET" MARKETING MIX

A key to a big win on this thrust is making the most of that very first impression with your target market. We can work right beside you to make this new launch as successful as possible by:

- producing all of the marketing & sales creative: copywriting, layout, advertising, multimedia, direct mail, web marketing, email marketing, sales support brochures, trade show flyers, etc.

- executing up to all of the marketing functions or coaching/assisting your own team in utilizing the most proven, highest ROI tactics in optimal ways.

- applying marketing science via statistical sampling to cost-efficiently break into new markets and make the most of current prospect pools. Crucial among these is identifying low-cost sources of relevant leads and best practices to woo them to your offerings. We're great at this very challenging piece of all membership models!

- using objective information to help you make optimal decisions about how you utilize your marketing budget.

- structuring the smartest, most cost-effective plan for each campaign and orchestrating the new acquisition, cross-sell & up-sell, renewal and loyalty programs to maximize your success.

Again, BI is a ONE-STOP-SHOP from rough idea to monetization... and beyond. We can do up to all of it FOR you or coach/train/assist your own team to take the reigns and run it yourselves. All you need to get started right now is the beginnings of an idea for such a business and a little time to talk it over with subscription model experts...

FOCUS ON ANOTHER VERY-IMPORTANT & OFTEN-OVERLOOKED METRIC TO HARVEST MUCH MORE PROFIT!

Many subscription model businesses put ENORMOUS focus on a core metric: new acquisition volume. New (subscription) starts today become "long tail" recurring revenue tomorrow. Newstarts certainly ARE a very important growth metric to track & nurture. They bring immediate cash and the promise of perhaps many years of future renewal revenue.

However, there is another metric that deserves at least EQUAL mind share... and it often does NOT get it. It is primarily about maximizing the subscriber base you already have (or aspire to grow). It is called ARPS (sometimes AARPS): average Annual Revenue-Per-Subscriber.

Where newstarts is a quantity metric, ARPS is a quality metric. Where newstart gains typically come with significant acquisition costs, ARPS gains can be up to entirely profit growth... and ARPS profit tends to be the BULK of a well-designed subscription model's profit. That's WHY it deserves much more consideration than it gets.

If you have a pretty good volume of subscribers now, a modest increase in ARPS can add a great deal of profit to your company. For example, if you have- say- 60K subscribers currently averaging about- say- $240/yr (current ARPS = $240), you have a $14.4M/yr business. Grow ARPS by only $25/yr (that's only about $2/month to your base) to add about $1.5M in mostly profitable new revenue. Or only $5/month adds approx. $3.6M/yr in mostly new profit. And so on.

Here's a table showing a variety of small membership model businesses and the impacts of getting only $2, $4, $6, $8 or $10 more each month out of their base...

| ARPS GAINS GO FARRRRR! | |||||

| SUBSCRIBER QUANTITY | $24 ARPS |

$48 ARPS |

$72 ARPS |

$96 ARPS |

$120 ARPS |

|---|---|---|---|---|---|

| 5K | $120K | $240K | $260K | $480K | $600K |

| 10K | $240K | $480K | $720K | $960K | $1.2M |

| 25K | $600K | $1.2M | $1.8M | $2.4M | $3.0M |

| 50K | $1.2M | $2.4M | $3.6M | $4.8M | $6.0M |

| 100K | $2.4M | $4.8M | $7.2M | $9.6M | $12.0M |

| 250K | $6.0M | $12.0M | $18.0M | $24.0M | $30.0M |

| 500K | $12.0M | $24.0M | $36.0M | $48.0M | $60.0M |

Take a look at the 50,000 subscriber business (row 4). Suppose we can bring that business an innovation or two to drive ARPS up by only $6 each month (the $72/yr column). Getting subscribers to give our client what amounts to the price of about one premium cup of coffee adds $3.6 MILLION to revenue. What if we move that base to swap 3 cups towards more ARPS growth? Our client adds well over TEN MILLION each year... from the very same base.

Take a look at the 50,000 subscriber business (row 4). Suppose we can bring that business an innovation or two to drive ARPS up by only $6 each month (the $72/yr column). Getting subscribers to give our client what amounts to the price of about one premium cup of coffee adds $3.6 MILLION to revenue. What if we move that base to swap 3 cups towards more ARPS growth? Our client adds well over TEN MILLION each year... from the very same base.

Again, the bulk of ARPS gains typically go right to the bottom line as PROFIT gains. What small-to-medium-sized membership model could not use an additional $3-10 MILLION DOLLAR PROFIT? Interesting? Now consider this...

We have rich & varied experience growing ARPS in multiples of 2X, 3X or more, not only at the tiny incremental gains described here. What would doubling your current (or initial) ARPS mean to your business? Tripling? We have helped clients do that many times.

Peloton- the digital fitness firm- recently reported 2.33 million subscribers on primarily 2 subscription tiers at $39.99/month (associated with the bike) and $12.99/month (classes only). 2023 annual revenue was $1.7B. Divide $1.7B by 2.33M subscribers to get a annual ARPS of about $729 or monthly at about $60 per subscriber.

What if that base could be motivated to give Peloton only $4-$10 MORE?

- $4 adds $9M/month or about $112M/yr

- $10 adds $23M/month or about $280M/yr

Doing some clever work with ARPS strategy & tactics could add $112M-$280M to Peloton's top line. If the existing ARPS is profitable now, much of that gain would fall through to the bottom line.

Executing a smart ARPS strategy on larger pools can yield amazing strides from seemingly-small changes. Each subscriber may view it as "only a FEW dollars more" but those minor up-sells are home runs when working with bases into the millions.

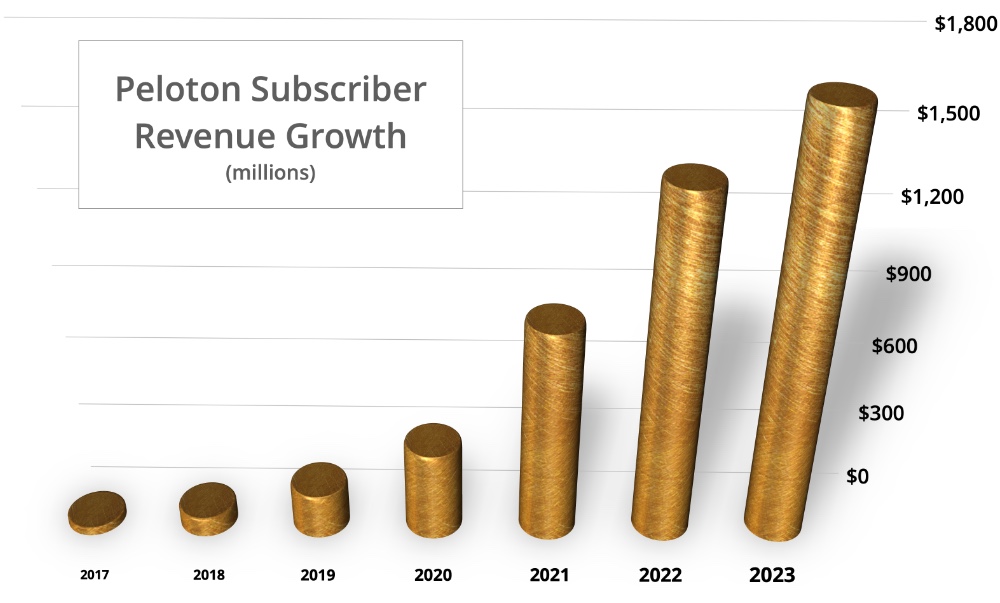

This chart shows the PACE of subscriber revenue growth in only a few years...

The rapid climb implies good fortune ahead as they add more buyers, launch new products and/or up-sell non-bike subscribers to add the bike (and higher subscription fee). The Peloton CEO recently shared they are aiming for north of 100M subscribers... about 50X these numbers.

If you are reading this through the lens of creating a new subscription business or model, also project the other way. Not so long ago, they had few subscribers. Step back only a little further and you soon reach a day when they had NONE. Take some inspiration & excitement from how lucrative a good concept can quickly become by applying:

- FOCUS on launching an appealing product or service,

- GREAT marketing plan, creative & plan execution and

- EXPERTISE at rapidly growing a membership base...

...in BOTH quantity of new subscriber acquisitions AND quality of each relationship (ARPS). Mix in shrewd retention strategies to KEEP subscribers for MANY years, and this annual revenue becomes multi-year revenue... jacking up lifetime value of each member.

ARPS GAINS FOR BILLION-DOLLAR MODELS

In even bigger subscription bases, ARPS successes are more striking...

- Apple doesn't report absolute numbers but it is estimated they have about 60 million paying subscribers. Apple is experimenting with a variety of subscription services and bundles to optimize ARPS.

- Google YouTube leaped from 30 million subscribers in 2020 to 80 million subscribers in 2022... and expects additional gains ahead. Pairing rapid new subscriber acquisition tactics with a smart ARPS (growth) strategy maximizes recurring revenue potential.

- Disney rolled out the Disney+ streaming service and roared to 130 MILLION subscribers as this is written and $8.4 billion in revenue. They have been effective with several subscription rate hikes in the last few years. They continue to engage in experiments such as bundling Disney + with Hulu and various ad-supported tiers. What are they really doing here? Experimenting at various price points and content offerings to maximize ARPS.

- Amazon Prime service estimates tally about 200 million subscribers. Amazon recently shared that Prime revenue is $25 Billion. Unlike the others where a few dollars can be a big percentage of their established ARPS, $1-$5/month increases for Prime would be a relatively minor change for consumers.

- Spotify leads all of music subscription services with 220 million subscribers. Each 50¢ added to the Spotify ARPS is worth over $110 million in added revenue. Move the base to pay only $1 more to add $220M in revenue. Grow ARPS by only $5 for more than $1 BILLION in added revenue.

- Netflix recently announced 248 million subscribers. What do those occasional rate hikes mean to them? If Netflix could drive ARPS up only $3 per month, that would yield just under $9 BILLION in additional annual revenue. Move that base to pay only $5/month more to harvest nearly $15 BILLION in additional revenue.

Just like one of the Peloton example points, none of these took decades to grow into billion dollar businesses. Instead, you can go back only a few years to reach a point where some had ZERO subscribers. ALL of them had zero if you hop only a little further. If you are reading this with only a subscription business idea and as little as ZERO subscribers now, take heart... and let's get with it... turning YOUR idea into lucrative recurring revenue. There's ZERO possible riches in hiding your great concept only in your imagination. Get started... get moving... and you can become the next great business success story.

Here's what potential gains look like for bigger players by raising ARPS only a tiny $1-$5 each month...

| ARPS IN BIGGER MODELS | |||||

| SUBSCRIBER QUANTITY | $12 ARPS |

$24 ARPS |

$36 ARPS |

$48 ARPS |

$60 ARPS |

|---|---|---|---|---|---|

| APPLE 60M | $720M | $1.4B | $2.2B | $2.9B | $3.6B |

| GOOGLE 80M | $960M | $1.9B | $2.8B | $3.8B | $4.8B |

| DISNEY 130M | $1.6B | $3.1B | $4.7B | $6.2B | $7.8B |

| AMAZON 200M | $2.4B | $4.8B | $7.2B | $9.6B | $12.0B |

| SPOTIFY 220M | $2.6B | $5.3B | $7.9B | $10.6B | $13.2B | NETFLIX 248M | $3.0B | $6.0B | $9.0B | $11.9B | $14.9B |

Whether big or small, modest ARPS gains can deliver HUGE upside in subscription models. Disney & Netflix customers certainly gripe about even $3-$5 monthly rate hikes, but most will pay. If the service (and service fulfillment cost) remains about the same, much of those BILLION dollar gains will be profit gains.

When assembling a subscription model, we always encourage clients to have a smart & complete ARPS strategy... or let our experts help develop one. If you have a good strategy BEFORE launch, you can mitigate customer gripes at price hikes by coming up with better ways to make paying YOU more be THEIR idea.

Would you like a proven strategy and/or tactics to grow ARPS? Hire us. We're great at innovating creative ARPS solutions for ANY subscription model. Your annual bonus will be much sweeter with only ONE success. And stakeholders or shareholders love strong profit growth! ARPS delivers bankable gains better than almost anything else you can do!

strong profit growth! ARPS delivers bankable gains better than almost anything else you can do!

If you are creating a new subscription model from scratch, it is VITALLY important to think through this ARPS component. Let us help you hatch a complete strategy BEFORE you launch and it can readily make your new thrust much more successful... not only at launch, but forever after. BI experience can create an optimal ARPS strategy & implementation.

In short: BI experts can do it all… best-in-class, best-of-breed subscription model solutions. Let us build a successful, recurring revenue stream(s) for your company! If you see even the slightest opportunity for something you offer to be repackaged as a membership or subscription product or service...

Related Topics You Might Want to View

ORIGINAL CREATIONS

We share great information about creating and installing a lucrative subscription or membership model from scratch, key business metrics to monitor AND how to apply them, a good comparison & contrast of the startup year vs. subsequent years and related insights.

MEMBERSHIP MODEL FIT

Explore subscription model suitability, evaluate if your idea naturally fits, learn the #1 mistake made in new subscription models, fundamentals of a successful model, 3 initiatives to quickly assemble & monetize, revenue potentials and 5 important truths for startups.

ENHANCE AN EXISTING MODEL

If you already have a membership engine, this article explores ways to enhance it. YES, there's always room for model improvements. We outline key answers every subscription model manager & owner should know and cover a case study about plugging retention holes.