How to get Your Competitor's Top Product Brains to Show You the Way to a Better Product or Service. Let Our Experts Help You Roll Out the "WOW!"

- This is page 3 of a 3-part article. If you landed here first, you might want to start on page one.

USING COMPETITOR RESEARCH TO DEVELOP A HOTTER PRODUCT OR SERVICE

An often overlooked but thoroughly-proven way to get your competitors to show you their best product marketing and everything great about their product is simple: be one of their customers. A little faux shopping will move them to show you every tactic they employ to nurture & close a sale. Be hard to close so they play EVERY card. Soak up every bit of their model like a sponge.

Then, actually buying what they sell will show you everything they do AFTER the sale AND give you a first-hand example of their "latest & greatest" to compare with what you sell. Tear into it... OBJECTIVELY identify its advantages (it DOES have some)... then nullify those advantages in your evolved version.

You can also leverage your competitors refined model by taking note of their dominant selling thrusts, particularly in how they attempt to differentiate their products from competitors (like your company). This is essentially tapping the most brilliant minds working for your competitors- people spending every hour of their workday trying to strengthen their product mix and take share from you. Done right, this is basically your competitor paying those people to help YOUR business.

Their brains PLUS your brains PLUS our brains is 2 sets of brains MORE than they are using. In creative work like product development, the best brains usually win.

We can help you source, document and identify their best concepts and blend them into your offerings. Our complete objectivity is key to making the most of this kind of work. Insiders have a hard time being objective: much too much accumulated bias sipping the company rah-rah about why 'our' products are better than everyone else's... and ridiculing anything that differs from 'our' perfection, even when some of those differences ARE obviously better.

If you have the budget to actually buy competitor products, you can also fully document their complete sales model. This gives you at-a-glance access to their best marketing creative, bonding & nurturing program, sales tactics, contact timetables for frequency of their various efforts to move customers towards a close, objection handling and answers to questions like:

to questions like:

- when do they follow up and (tactically) how?

- exactly how do they build value?

- exactly how do they differentiate?

- what are the key hot buttons they push?

- what are their purchasing options?

- what exactly do they do that differs from your sales model?

- what stands out in their marketing?

- etc. (there are many more)

If you do this specialized form of mostly listening to those who own the major slices of your market's pie, you end up with quick-glance summaries of every key advantage, tactic, etc they use against you. Fix the weaknesses, evolve your offering(s) to better compete, weave superior approaches into your own model and BAM: you become KING of your space. If you want a BIGGER slice of that very profitable pie, this is THE way.

PRODUCT DEVELOPMENT CONSULTANTS HELP YOU DO IT RIGHT

Utilizing an outside team like BI is a way to covertly mask the real purpose of the purchase. In other words, if a known competitor is buying a product, the sales presentation will adapt... as it is obviously not a normal sales transaction. If you want to get the clearest picture of competitor sales models, tactics, etc, you want your buyer to seem as real to your competitor as any other prospect. This will motivate them to execute their sales model in a normal way, giving you the opportunity to document everything they do better than your own model. Absorb their advantages and your sales model becomes STRONGER yielding more revenue & profit.

If your product or service mix facilitates it, have some faux shopping done on your company too. If we keep the shopper in the dark about WHICH company is the client, the analysis will be that much more objective. What you do best will rise to the top. Where you don't excel will be documented too... so that you can subsequently do something about those issues.

Objective summaries from the 2 dimensions- customer research AND competitive analysis- are presented to the internal team to expose them to what is often many alternative observations and recommendations vs. what is generally assumed. Most can be quantified & verified by statistical measures, which can help prevent them from being dismissed because "we didn't think of that" or a fear of the implied change that would follow acceptance. More importantly: this trove of customer & competitor intelligence will spur INTERNAL innovation, as all quality, new information will do. It is a powerful catalyst for the third dimension where- instead of only matching competitors- you actually TAKE SEVERAL STEPS AHEAD of them.

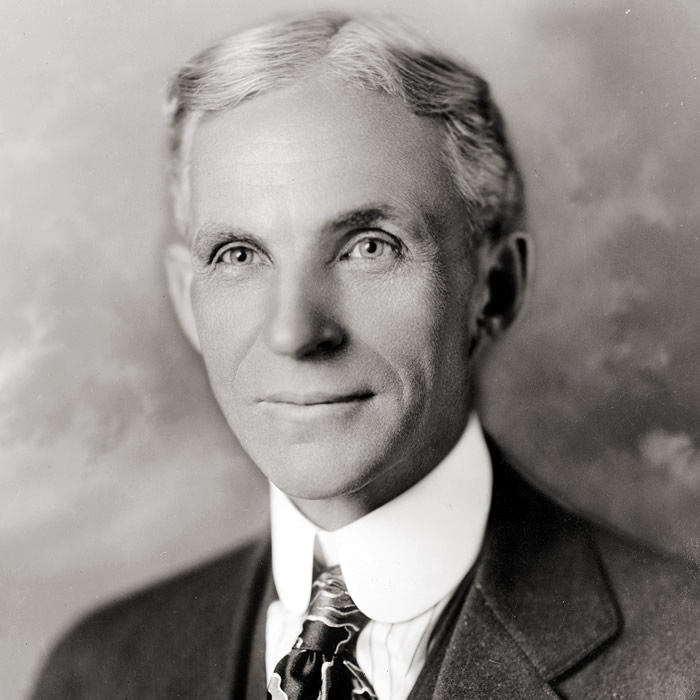

A very simple example of the power of market research and the hazards of NOT doing it can manifest in something as seemingly-rudimentary as a coat of paint. At one point, Ford dominated the automobile industry. Their slice of the pie was much greater than ALL competition. There is a famous quote attributed to founder Henry Ford...

A customer can have a car in ANY color he wants... so long as it is BLACK.

It's an unfortunate echo of an earlier quote also attributed to Ford: "If I had asked people what they wanted, they would have said faster horses." While often affectionately viewed as perhaps puffing up his own massive genius, take another look: this probably shows some disrespect for his own market.

Yes, some of his customers at the start of the company may have only been able to imagine a faster horse. But that would STILL be market-driven insights into a buyer want that would directly support his new invention. They were not asking for super-horses but desired a way to get from here to there FASTER than a horse could run. A little (respectful) research then would shore up the "crack-pot" idea of an affordable "horseless carriage" for the masses. In this case, some egomania didn't backfire.

Stepping forward in time, the market was maturing. Ford was comfortably king but competitors were looking for ways to take share. Ignoring simple buyer analysis about automobile colors at the time (or perhaps being overly focused in the modest cost savings of painting all cars one color instead of offering a broader palette) made Ford miss out on retaining the same share of sales when competitors learned to give car buyers what they collectively wanted: more colorful cars.

Eventually, Ford had to adapt by rolling out cars in other colors. But there was no way to go back and reclaim the customer money that went to competitors who took advantage of that insight. All it would have taken was some cheap surveying of prospective new car buyers, ranking the things they would like to see in upcoming cars, then working out ways to evolve the product(s) towards the higher-ranked wants on that list. Instead, HE knew better... right up until the market forced him to learn a costly lesson.

At the time, his managers were probably biased and/or programmed to never counter the boss's view of such matters. Corporate politics might have made some bite their tongue rather than risk going against the corporate view… even if they thought the boss was wrong about this one. Emotions like fear can make very intelligent managers choose NOT to counter their superior. Job security concerns- real or imagined- can make bright employees strive to disappear (in plain sight) rather than boldly step forward with some valuable counterpoint.

Ford's staff might have dismissed a customer-driven recommendation: even one backed by the statistical validity of near-term buyer research. As a result, this narrow-mindedness and/or fear fed into competitor aspirations to take market share from Ford. And it WORKED! They would never get back that dominant share.

This very same strategic issue is an extraordinarily common problem in many/most companies well into the 21st century. In some ways, it's a major contributor to why the consulting and contracting industry exists...

There's no substitute for truly objective views of companies, products, approaches, models, markets, etc.

We have no corporate biases. Company politics do not drive our viewpoints... and we are not married to "we've always done it this way" mentalities.

Instead, consultants can offer a clarified lens in all of these kinds of matters, and recommend ways to help clients discover that it's time to adapt or evolve... BEFORE it costs them much share... or so they can take share from a stubborn, egomaniac-led competitor who "know what customers want better than they know themselves" (not exactly a leadership mentality exclusive to Henry Ford).

Ford).

Do you have a competitor(s) who likes to decide what customers should like FOR those customers? Probably. Want to take a bite of their slice of the pie? We just offered one of the golden keys on our keychain for doing exactly that. And there's more where that came from.

BI is EXPERT at the collective brilliance model. We offer collaborative or turnkey execution and leadership of all 3 dimensions. We can help your company develop, install and run its own incarnation of it, or execute this kind of work as a fully objective, outsourced solution. We know of no better way to develop or evolve wow products or services while minimizing the risk of product failures. Contact us for a free consultation. We can apply proven solutions to helping you evolve your offerings into "WOW!" forms... the ultimate catalyst to record revenue.